[ad_1]

Hyderabad: The revival in residential demand led to a five per cent rise in prices in the top eight cities of Delhi-NCR, Mumbai Metropolitan Region (MMR), Kolkata, Pune, Hyderabad, Chennai, Bengaluru and Ahmedabad, while a marginal decline was recorded in Is. Unsold inventory during the second quarter (Q2) of 2022. According to CREDAI-Colliers-Liasse Foras Housing Prices (…)

Updated – August 16, 2022, 10:42 pm

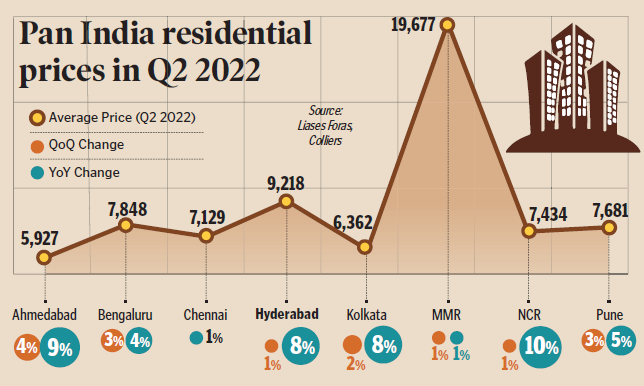

Hyderabad: The revival in residential demand led to a five per cent rise in prices in the top eight cities of Delhi-NCR, Mumbai Metropolitan Region (MMR), Kolkata, Pune, Hyderabad, Chennai, Bengaluru and Ahmedabad, while unsold inventory recorded a marginal decline. Has been. During the second quarter (Q2) of 2022.

According to the CREDAI-Colliers-Liasse Foras Housing Price Tracker Report 2022, residential prices, which have crossed pre-pandemic levels, are witnessing an upward trend due to rising demand amid rising prices of construction materials.

Delhi-NCR saw the highest year-on-year rise in residential prices at 10 per cent, followed by Ahmedabad and Hyderabad which saw nine per cent and eight per cent year-on-year growth, respectively.

The sales momentum that started in the latter half of last year continued in the second quarter of 2022 due to pent-up demand and attractive pricing, the report said, adding that rising prices and new launches in the last few quarters Despite the increase, most cities saw a decline in unsold inventory.

Bengaluru saw the biggest decline of 21 per cent year-on-year in inventory overhang due to higher sales. Only Hyderabad, MMR and Ahmedabad saw an increase in unsold inventory, led by significant new launches. MMR still has the highest share in unsold inventory at 36 per cent, followed by Delhi-NCR at 14 per cent and Pune at 13 per cent.

CREDAI national president Harsh Vardhan Patodiya said the central bank has continued to increase repo rates to mitigate the impact of inflation and banks are expected to increase loan interest rates, including home loans.

“Housing prices in cities have increased between two per cent and five per cent, as material and labor costs remain high. We may see a slight decline in demand due to rising interest rates, but sales will continue to grow across all segments from September as we enter the festive season.”

Ramesh Nair, CEO of Colliers Asia, and Pankaj Kapur, managing director of Liases Foras, also reiterated the view that market sentiment will remain high in the upcoming festive season, resulting in higher sales.

The report said the rise in home ownership among the millennial generation, supported by higher disposable income and a desire to upgrade to larger spaces equipped with better amenities, has driven a sharp increase in housing demand over the past few quarters.

[ad_2]

Source link