[ad_1]

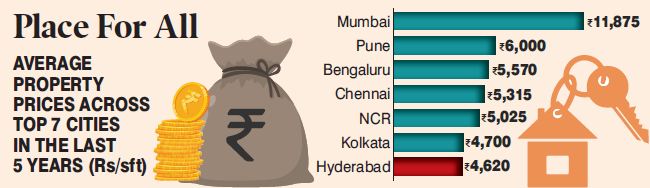

The average property price is significantly lower than prices in the six other top cities

Published Date – 22 February 2023, 07:00 AM

Hyderabad: Despite a steady increase in property prices driven by factors such as rising demand for housing, the city’s robust economic growth and all-round infrastructure development, Hyderabad continues to be an affordable city to buy property compared to six other top metros in the country.

A recent report by property consultant Anarock compared average property prices in Delhi-NCR, Kolkata, Mumbai, Pune, Hyderabad, Chennai and Bengaluru. It found that the average property price in Hyderabad is Rs 4,620 per sq ft, which is much lower than the average property prices in other cities.

The real estate market in Hyderabad is growing at a steady pace, with demand for residential and commercial properties on the rise. The state government’s efforts to develop infrastructure and improve connectivity have played a key role in boosting the real estate sector and the city also houses several major IT companies, attracting a large number of working professionals.

Hyderabad has seen a maximum increase of 10 per cent in average property prices in the last five years. Still, it remains one of the most affordable cities to buy property in India.

The average price in the city was Rs 4,128 per sq ft in 2018 which is expected to rise to Rs 4,620 per sq ft in 2022. While average property prices in Bengaluru rose to Rs 5,570 per sq ft in 2022, Mumbai topped the list with Rs 11,875 per sq ft in 2022, followed by Pune (Rs 6,000 per sq ft).

Prashant Thakur, senior director, research, Anarock Group, said 2022 saw the maximum annual increase in average property prices, “Post-pandemic; demand across cities swelled – as did developers’ input costs – leading to price increases, especially in 2021 and 2022.”

He added that another reason for the price rise is that most of the sales happening now are being done by branded developers, who have not hesitated to hike prices due to strong demand and rising construction costs. Growth is expected to continue in 2023 as well based on end-user demand, but serious long-term investors will find the market dynamics more than favorable.

[ad_2]

Source link